child tax credit 2021 dates irs

15 opt out by Aug. I called them yesterday because it makes no sense to me that it would be that l owe.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

. 3000 for children ages 6 through 17 at the end of 2021. The 500 nonrefundable Credit for Other Dependents amount has not changed. If they claimed the Child Tax Credit for their child on their 2020 return then they would have received the advance Child Tax Credit payments.

IRS revises 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions Graham ONeill 16939. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The Michigan mother of three including a son with autism used the money to pay.

Find COVID-19 Vaccine Locations With. 3600 for children ages 5 and under at the end of 2021. Learn more about the Advance Child Tax Credit.

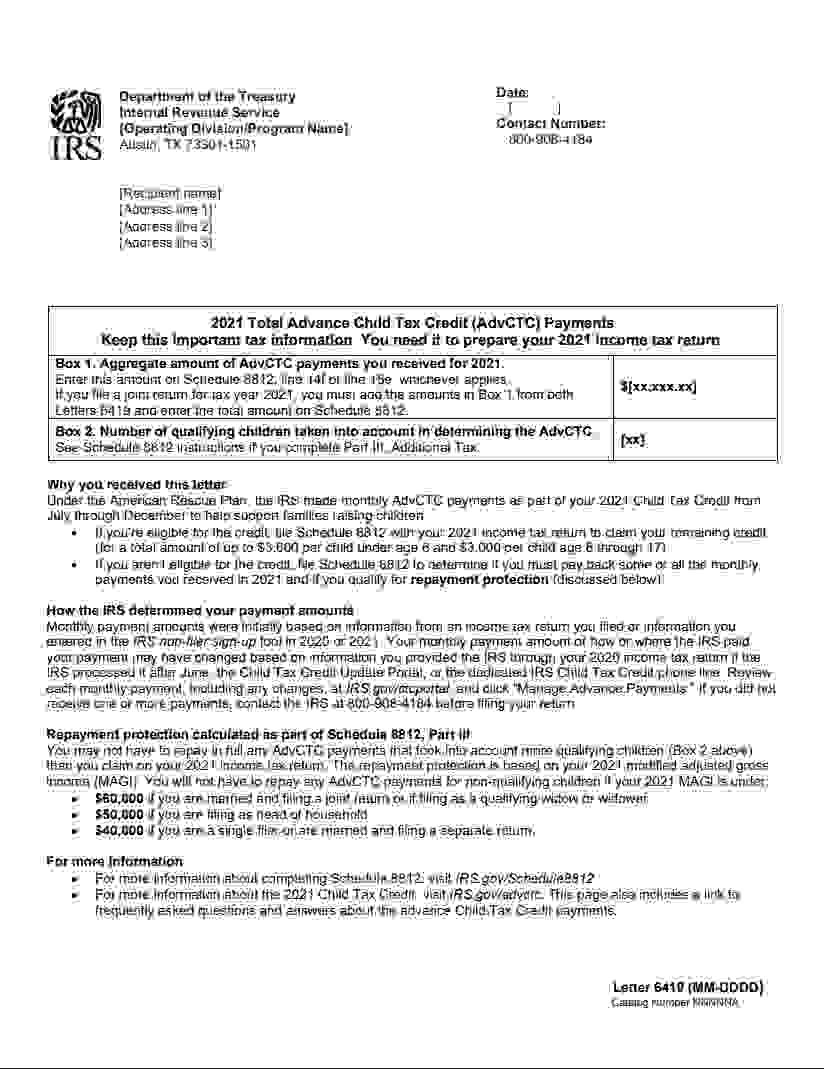

You need that information for your 2021 tax return. Atlanta Internal Revenue Service 4800 Buford Hwy Chamblee GA 30341. This portal closes Tuesday April 19 at 1201 am.

Enter your information on Schedule 8812 Form. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. 15 opt out by Nov.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic O. Andover Internal Revenue Service 310 Lowell St.

Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit. When you file your 2021 tax return you can claim the other half of the total CTC. I got a letter in the mail from the IRS letting me know that I have received my refund and that it was changed to 16.

Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you. 29 What happens with the child tax credit payments after December. IRS revises the 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 15 opt out by Oct. IRS online portal now available in Spanish.

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy. 3000 for children ages 6 through 17 at the end of 2021. Date Date 1 - 1 of 1 previous page.

IR-2021-228 IRS unveils new online identity verification process for accessing self-help tools. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Get your advance payments total and number of qualifying children in your online account.

Shows the third Economic Impact Payment advanced for tax year 2021. IRS - The Basics. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

15 opt out by Nov. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit.

IR-2021-235 Child Tax Credit payments. 29 is last day for families to opt out or make other changes. To reconcile advance payments on your 2021 return.

IR-2021-153 July 15 2021. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition.

Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. 2 days agoWASHINGTON DC The IRS today issued a revised set of frequently asked questions for the 2021 Child Tax Credit.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. These frequently asked questions FAQs are released to the public in Fact Sheet. If an individual was a US.

This first batch of advance monthly payments worth roughly 15 billion. FS-2022-29 May 2022. The IRS bases your childs eligibility on their age on Dec.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. My refund was 16 because I received a stimulus check in 2021. 31 2021 so a 5-year-old child.

The IRS noted that it determined who received 2021 advance Child Tax Credit payments based on the information on their 2020 tax return or their 2019 return if the IRS hadnt processed their 2020 return. Child Tax Credit FAQs for Your 2021 Tax Return The IRS sent the sixth and final round of child tax credit payments to approximately 36 million. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Georgia Iowa Kansas Kentucky Virginia. Shows the second Economic Impact Payment advanced for tax year 2020. In early 2022 IRS will send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

SSA before the due date of your 2021 tax return including extensions. Citizen when he or she received the SSN then it is valid for employment in the United States. Child Tax Credit Update Portal to Close April 19.

IR-2021-153 July 15 2021. The lady I spoke with basically told me that I owed 1400 in taxes because I. 13 opt out by Aug.

Child Tax Credit 2021 Changes Grass Roots Taxes

File Taxes For 2021 To Receive Your Full Child Tax Credit

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Irs Child Tax Credit Payments Start July 15

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Child Tax Credit Dates As Irs Set To Send Out New Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Advance Monthly Payments Explained Donovan

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com