proposed estate tax law changes

Simpler faster more transparent and affordable way to settle an estate. Texas Property Tax Law Changes 2021 1 Tax Code Chapter 5.

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Tuition Payment Federal Income Tax Tax

House and Senate Democrats are working with the Biden administration to pass legislation to fund their infrastructure initiatives including.

. Provide Tax Relief To Individuals and Families Through Convenient Referrals. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. While the current tax applies to the full value of estates over 1 million Bakers bill.

State Administration Section 503 SB 63 and HB 3786 add subsection d allowing the Comp-troller after giving notice to. The proposed changes are so drastic and impactful on estate planning and probate that you need to know what is out there. The top four areas to watch are the federal.

Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for inflation. Estates valued over 35 million but less than 10 million would be subject to an estate tax. Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026.

Some of the more important proposals. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. On September 13 2021 the House Ways and Means Committee released its proposal for funding the Build Back Better Act detailing multiple changes to current tax law in.

Increasing top tax rates for individuals. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in. The For the 995 Percent Act proposes a sliding scale for rates as follows.

Recent information regarding the proposed tax changes by the Biden Administration includes a proposal to reduce the federal estate and GST tax exemption from 11700000 per individual. That is only four years away and. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Estate and Gift Tax Exclusion Amount. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Proposed Estate Tax Law Changes.

Ad With ClearEstate independent executors can save up to 120 hours and 8500 in fees. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code. Simpler faster more transparent and affordable way to settle an estate.

The 995 Percent Act would make significant and direct changes to the estate gift and generation skipping transfer GST tax rules. Ad Based On Circumstances You May Already Qualify For Tax Relief. Under Bakers plan the threshold at which the estate tax kicks in would double to 2 million.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. Understand the different types of trusts and what that means for your investments. Ad With ClearEstate independent executors can save up to 120 hours and 8500 in fees.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

How The Tcja Tax Law Affects Your Personal Finances

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Tax Definition Federal Estate Tax Taxedu

How To Plan Around Estate Tax Uncertainties Charles Schwab Estate Tax Capital Gains Tax Tax

Find The Best Wills And Estate Planning Lawyer In Ca Estate Planning How To Plan Estates

Estate Tax Law Changes What To Do Now

Train Package 1 Train Package Estate Tax Train

How The Tcja Tax Law Affects Your Personal Finances

How To Settle An Estate Estate Planning Checklist Estate Planning Revocable Living Trust

Biden Budget Biden Tax Increases Details Analysis

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

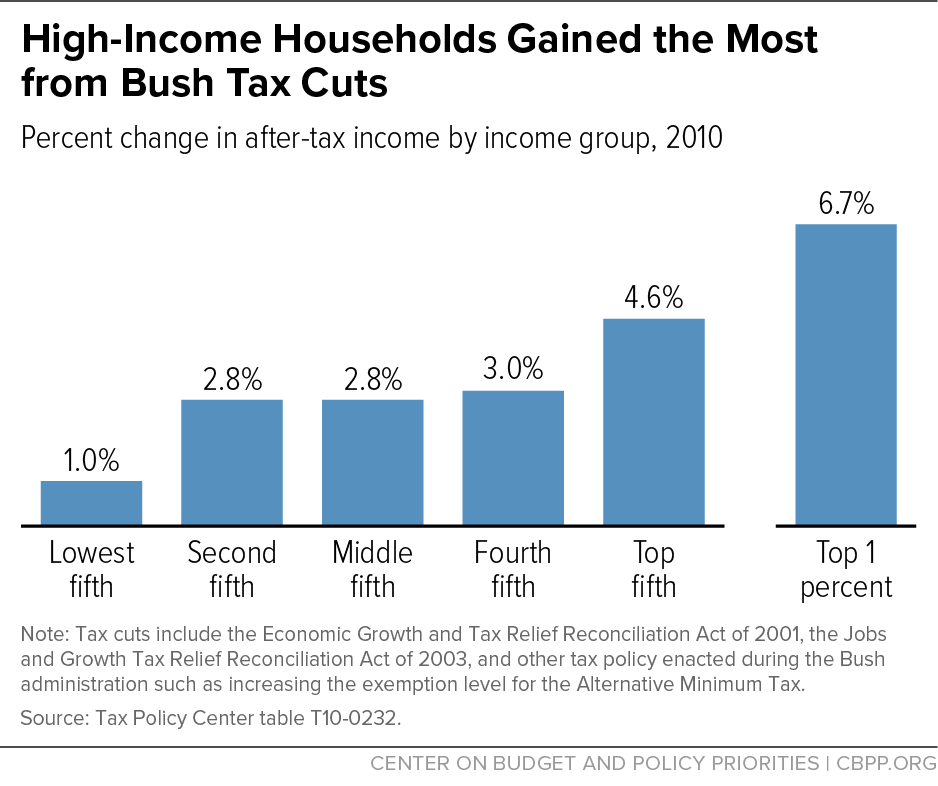

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

The Backforty Newsletter Of Land Conservation Law May June Etsy Estate Planning Conservation Land Trust

Where Not To Die In 2022 The Greediest Death Tax States

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)